Introduction

Investors in India today have many choices: Mutual Funds (MFs), Portfolio Management Services (PMS), and now Specialized Investment Funds (SIFs) – a new category introduced by SEBI in April 2025.

But what’s the difference? And which one suits you? Let’s break it down simply.

Simple Definitions

- Mutual Fund (MF): A pool of money from lakhs of investors managed by a fund manager. Best for retail investors.

- Portfolio Management Service (PMS): A customized service where your portfolio is managed individually. Best for HNIs (₹50 lakh+).

- Specialized Investment Fund (SIF): A brand-new SEBI category (2025). Think of it as “structured strategies” accessible to more investors than PMS, but more advanced than MFs.

SIF vs Others

| Feature | MFs | SIFs | PMS | AIFs |

|---|---|---|---|---|

| Regulatory Oversight | High | High | Moderate | Moderate |

| Investment Flexibility | Relatively Low | Very High | High | Very High |

| Minimum Investment | ₹500 onwards | ₹10 lakhs* | ₹50 lakhs | ₹1 crore |

| Target Investors | Retail, HNI, Institutional | HNI, Institutional | HNI, Institutional | Sophisticated HNI, Institutional |

| Strategies | Primarily Long-only | Long-Short | Tailored (Long-Only) | Diverse (PE, Hedge Funds) |

| Transparency | High | High | Moderate | Moderate |

* Minimum Investment for SIFs not applicable to certain accredited investors.

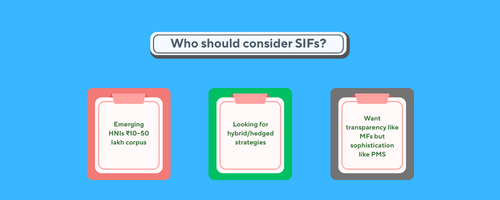

Why SIFs are Different

- Lower entry barrier than PMS (₹10 lakh vs ₹50 lakh)

- Sophisticated strategies (long-short, hedging, structured)

- Transparency in taxation (no fund-level tax)

- Designed for the ₹10–50 lakh investor segment

- First movers: Quant AMC launched 2 SIFs, more coming soon

Taxation

MFs: Taxed like equity/debt funds.

PMS: Direct gains/losses in investor’s account.

SIFs: Pass-through at investor level.

| Asset Type | MFs | PMS | SIFs |

|---|---|---|---|

| Equity LTCG | 12.5% (>12m) | 10–12.5% | 12.5% |

| Equity STCG | 20% or slab | Slab rate | Slab rate |

| Interest/Dividend | Taxed at fund level | Investor’s slab | Investor’s slab |

Real-Life Example

Investor A – Ramesh, IT Professional

- Has ₹12 lakh to invest.

- MF? Too simple, returns moderate.

- PMS? Not eligible (needs ₹50 lakh).

- SIF? Perfect entry. Gets structured, hedged strategies.

Final Thoughts

SIFs are not a replacement for MFs or PMS. Think of them as the middle bridge — giving HNIs with ₹10–50 lakh access to advanced strategies.

With more AMCs set to launch SIFs, this category could be India’s next big 5–10x growth story in alternative investments.

Stay Updated

Want to track new SIF launches, fund details & strategies?

👉 Explore India’s first SIF-only platform: SIF360.com