Overview

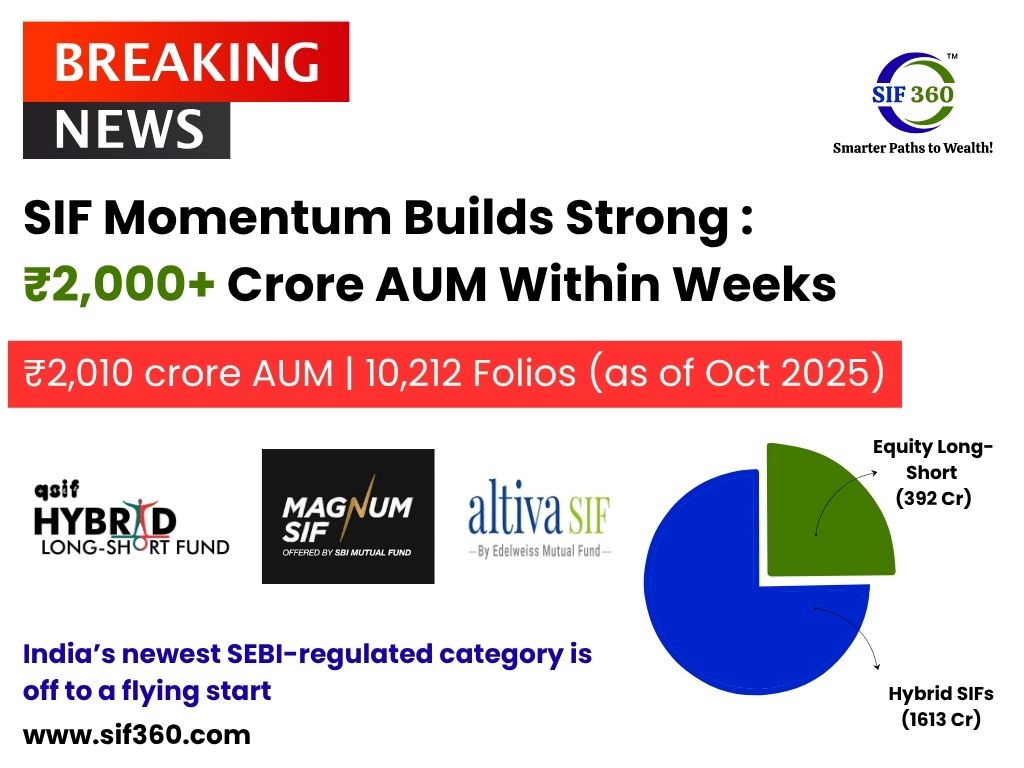

According to AMFI data (Oct 2025), total SIF AUM stands at ₹2,010 crore with 10,212 investor folios, marking a robust start for this innovative category.

Early Movers: Quant, SBI & Edelweiss

Three major fund houses — Quant, SBI, Edelweiss — led the first wave of SIFs, offering strategy-driven solutions:

- Quant Mutual Fund QSIF Series — India’s first full SIF suite with multiple strategy-based offerings.

- SBI Magnum SIF (Hybrid) — Blending stability with strategy through an actively managed approach.

- Edelweiss Altiva SIF — Agile long-short hybrid strategy for market cycles.

Hybrid SIFs attracted ₹1,613 Cr across 7,471 folios, while equity long-short category raised ₹392 Cr (AUM ₹397 Cr).

What Makes SIFs Different

SIFs offer strategy-driven, flexible investing with mutual fund convenience plus PMS/AIF-like tools:

Long–short strategies

Hold both long and short positions for alpha & hedging.

Derivative overlays

Use options and futures for tactical exposure.

Relative value & tactical allocation

Exploit market inefficiencies effectively.

Minimum investment ₹10 lakh opens access to institutional-grade portfolio design.

The Road Ahead

SIFs are no longer a “future concept”; they’re today’s opportunity.

More fund houses entering the space is making it India’s next big investment frontier.

📈 SIFs are just getting started — and the momentum is only building.