Altiva Hybrid Long-Short Fund

A balanced fund blending equities, fixed income, and derivatives to deliver consistent, low-volatile returns across market conditions.

Altiva Hybrid Long-Short Fund Details

| Investment Objective | The primary objective of the investment strategy is to generate capital appreciation through equity and equity related instruments and income through arbitrage, derivatives strategies, special situations and fixed income investments. There is no assurance that the investment objective will be achieved. |

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| Category of Investment Strategy | Hybrid Long-Short Fund |

| Type of Investment Strategy | Interval |

| Fund Manager | Equity: Mr. Bharat Lahoti, Mr. Bhavesh Jain Debt: Mr. Dhawal Dalal, Ms. Pranavi Kulkarni Overseas: Mr. Amit Vora |

| Subscription & Redemption | Subscription: Daily Redemption: Twice in a week (Monday and Wednesday) |

| Plan & Options | Direct, Regular Growth, IDCW |

| Exit Load | If the units are redeemed/switched out on or before 90 days from the date of allotment – 0.50% of the applicable NAV. If the units are redeemed/switched out after 90 days – Nil |

| Minimum Application Amount | INR 10 lakh |

| Features | Lump sum, SIP, SWP, STP |

| Min Investment in SIP, STP, SWP | Rs. 1,000 and in multiples of Re. 1/- thereafter (subject to minimum investment of Rs 10 lakh) |

Please refer to SID for more details.

What makes this fund an attractive opportunity?

Why Choose Altiva?

The Altiva Hybrid Long-Short Fund blends equities, fixed income, and derivatives to help achieve consistent returns in most market conditions.(Interval investment strategy in equity & debt, with limited short exposure via derivatives.)

Well-positioned to serve targeted needs

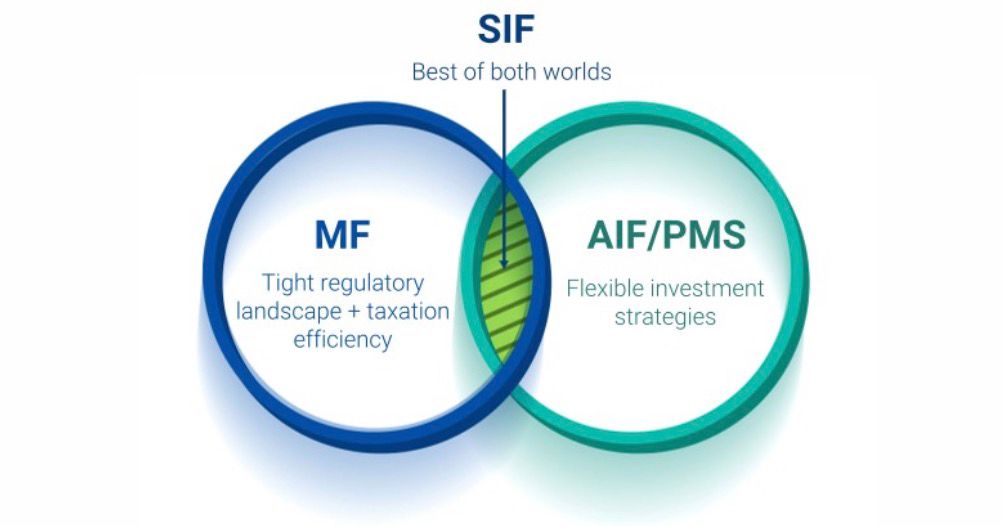

SIF = Best of both worlds

Core Income + Enhanced Drivers

Arbitrage

Fixed Income

Special Situations

Derivative Strategies

Arbitrage & fixed income form the foundation, with selective opportunities in special situations and derivatives for enhanced returns.

Portfolio Construction

Cash-Future Arbitrage & Covered Call

Capture low-risk returns via arbitrage opportunities

Allocation: 20–40%

Fixed Income

Invest in quality debt to generate accrual & appreciation

Allocation: 40–60%

Special Situations

IPOs, buybacks, mergers, index inclusion, etc.

Allocation: 0–10%

Derivative Strategies

Long-short, straddle, strangle, put-call parity, etc.

Allocation: 10–20%

What Makes This Fund Attractive?

Consistent Income

Stable fixed-income like returns with moderate equity growth.

All-weather Strategy

Multiple strategies for smoother outcomes regardless of market cycles.

Tax Efficiency

Long-term capital gains taxed at just 12.5% post 2 years.

Robust Risk Management

Active monitoring and strict risk controls reduce volatility.

Experienced Team

Specialized managers with strong track record in derivatives & special situations.

Scheme Details

| Name | Altiva Hybrid Long-Short Fund |

| Objective | Capital appreciation + stable income through equity, arbitrage, derivatives, and fixed income. |

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| Category | Hybrid Long-Short |

| Frequency | Subscription: Daily | Redemption: Mon & Wed |

| Exit Load | 0.5% if redeemed 180 days | Nil after |

| Min Investment | ₹10 lakh |

| Features | Lump sum, SIP, STP, SWP |

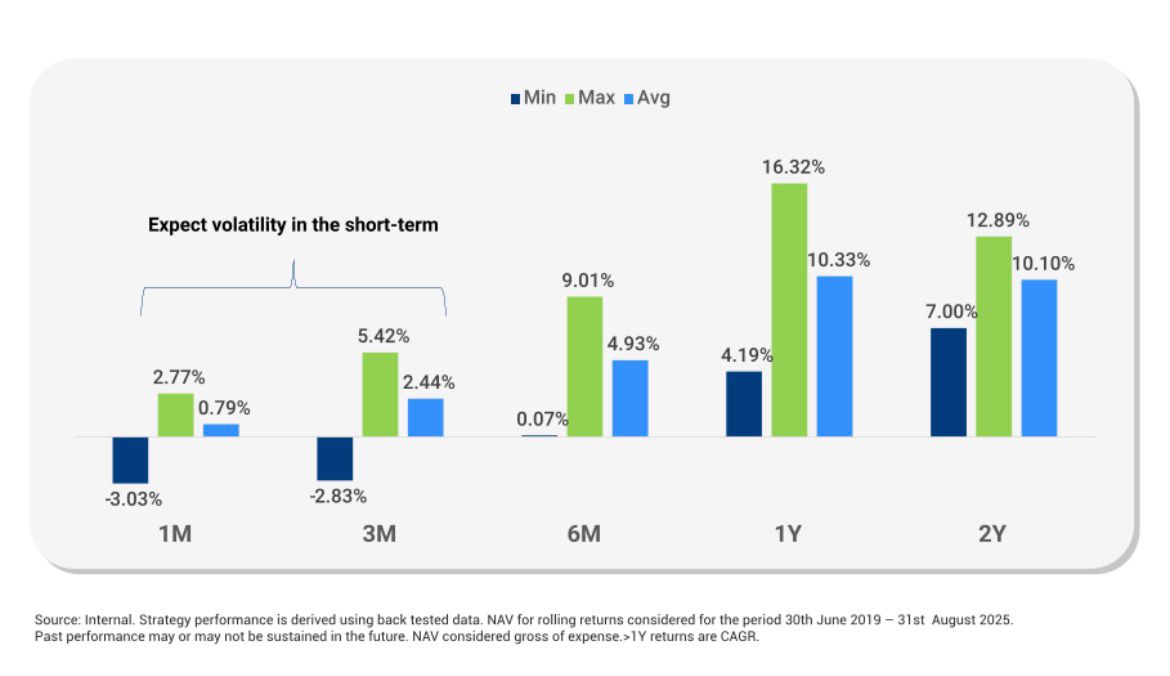

Back-tested Strategy – Rolling Returns

Historical simulations (Jun 2019 – Aug 2025) show stable outcomes with lower volatility across time horizons.

What to Expect in Different Market Conditions

Flat Market

- Covered Call + Arbitrage

- Debt

- Derivatives

- Special Situations

Bull Market

- Long Equity*

- Special Situations

- Derivatives

- Covered Call

Bear Market

- Short Equity

- Debt

- Arbitrage

- Buybacks/Open Offers

Performance Notes

- Underperform: Sharp bear & volatile markets, very low rates

- Outperform: Bull + Flat markets, rising interest rate cycles

Disclaimer

Investments in Specialized Investment Funds involve risks, including capital loss, liquidity risks, and market volatility. Please read all related documents carefully before investing.